- Javali Communications

- Case Study

- Bharat Financial Inclusion Limited

Bharat Financial Inclusion Limited

A Step Towards Financial Revolution A Step Towards Financial Revolution

Take the Step, Shape the Future of Finance!

Discover MoreBharat Financial Inclusion Limited's Grand Launch for Financial Education

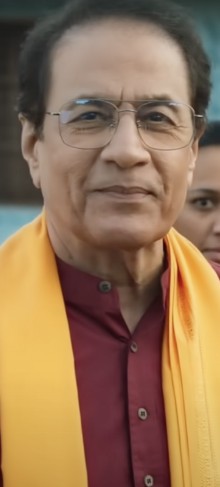

Established in 1997, Bharat Financial Inclusion Limited (BFIL) is a wholly-owned subsidiary of IndusInd Bank. It works to advance microfinance to underserved communities across India. With a legacy spanning over two decades, BFIL helps with financial empowerment through customized microfinance solutions. In May 2023, BFIL started a landmark Customer Awareness Program in Odisha, inaugurated by the Honorable Governor Prof. Ganeshi Lal Ji, to boost financial literacy. In collaboration with Javali Comms, BFIL continues to expand its influence, affirming its leadership in India’s financial era.

Roadblocks in the

Customer Awareness Program

Geographical Diversity:

- Vast Reach Requirements: Rolling out the Customer Awareness Program across Odisha’s varied landscapes and communities presented considerable logistical challenges.

- Local Engagement Strategies: Tailoring the program to align with the diverse cultural and social norms of different regions required a profound understanding of local contexts.

Technological Integration:

- Deployment of LED Vans: Using LED vans to promote financial literacy faced difficulties in areas with limited technological exposure.

- Digital Literacy Barriers: Overcoming the gap between digital tools and the audience’s digital literacy was crucial. This required simplifying complex financial information into easily digestible content for LED displays and interactive sessions.

Participant Coordination:

- Aligning with Government Authorities: Collaborating with local government bodies and securing approvals for events and LED van deployments involved navigating bureaucratic processes.

- High-Profile Involvement: The involvement of the Honorable Governor of Odisha added complexity to the event’s planning and execution, requiring heightened security measures and strict protocol management.

Community Trust Building:

- Empowering Marginalized Groups: To support marginalized and underserved women, educational initiatives and trust-building activities were key.

- Sustaining Engagement: Maintaining long-term community engagement beyond initial interactions posed challenges, requiring follow-up initiatives and a consistent presence for lasting impact.

DISCOVER PREMIUM SOLUTIONS with JAVALI COMMUNICATIONS

Javali Comms’ Approachto Financial Literacy in Odisha

Planning and Research: To ensure the success of the Customer Awareness Program, Javali started with comprehensive market research and a needs assessment. We identified key demographic segments and tailored our strategies to specifically address the needs of marginalized and underserved women in Odisha. This foundational step was essential in targeting the financial literacy gaps and fraud prevention issues most relevant to these communities.

Collaborative Design and Development: In partnership with Bharat Financial Inclusion Limited, Javali crafted an awareness program that seamlessly integrated educational content with interactive delivery methods. Utilizing both digital platforms (LED vans) and physical events (on-the-ground activations), we ensured that the message of financial empowerment reached a wide audience in an impactful and efficient manner.

Implementation and Localization: Our campaign was designed to be hands-on and community-driven. We organized small, localized events across Odisha, fostering an environment that encouraged learning and active participation. Each event featured interactive financial education sessions, while also inviting feedback and engagement from local communities.

Monitoring and Scaling: After launch, Javali implemented a robust monitoring system to track the reach and impact of the campaign. By gathering real-time data and community input, we continuously refined our strategies and scaled successful components, enhancing the program’s overall effectiveness. This ongoing evaluation allowed us to maintain community engagement and adapt to evolving needs.

Campaign Success | The Impact of Bharat Financial's Literacy Initiative

Financial Literacy Advancements: The initiative resulted in a notable increase in financial literacy, particularly among marginalized and underserved communities in Odisha. Through engaging, interactive sessions and the strategic deployment of LED vans, the program effectively communicated vital information about financial products and fraud prevention.

Empowerment through Knowledge: The program’s educational focus empowered participants, especially women, by providing them with the knowledge and tools needed to make informed financial decisions with greater confidence and independence. This newfound empowerment fostered increased economic participation and began to shift community norms toward greater financial inclusion.

Strengthened Community Ties: The organized events throughout the state fostered strong community engagement, marked by high attendance and active participation. These gatherings helped build trust, enhance cooperation among residents, and strengthened the social fabric, ultimately improving the collective financial resilience of the communities involved.

Organizational Visibility: The campaign greatly enhanced Bharat Financial Inclusion Limited’s visibility within Odisha and beyond. The launch event, attended by the Honorable Governor of Odisha, alongside extensive grassroots activities, garnered widespread media attention and public interest, amplifying the reach and impact of their financial literacy efforts.

Ready to make a difference?

Take the first step toward creating lasting change in your community or organization with Javali Comms—where your vision becomes our mission.

Reach out today and start your journey!

Javali Communications

Plot No. 450, Street No. D-21, Second Floor, Chattarpur Hills, Delhi 110074, India